VA loans are a fantastic opportunity for veterans and service members to purchase a home with no down payment and competitive interest rates. Backed by the U.S. Department of Veterans Affairs, these loans offer significant advantages over traditional mortgages. This comprehensive guide will help you understand everything about VA loans, from eligibility requirements to the application process, as well as the benefits and limitations.

Table of Contents

Understanding VA Loans

What Is a VA Loan?

A VA loan is a mortgage backed by the U.S. Department of Veterans Affairs. This government guarantee allows private lenders, such as banks and mortgage companies, to offer more favorable terms, including zero down payment, competitive interest rates, and no private mortgage insurance (PMI) requirements. These loans can be used for buying, building, improving, or refinancing a home.

History and Purpose of VA Loans

Introduced in 1944 as part of the GI Bill, VA loans were designed to help returning World War II veterans buy homes. The program, overseen by the U.S. Department of Veterans Affairs, aims to make homeownership more accessible for veterans by reducing financial barriers. By providing a government guarantee, it encourages lenders to offer more favorable terms to veterans. Today, it continues to serve millions of veterans, making homeownership attainable for those who have served.

Key VA Loan Benefits and Limitations

Advantages of VA Loans

- No Down Payment: Qualified borrowers can purchase a primary residence without a down payment, making homeownership more accessible.

- No Mortgage Insurance: VA loans do not require private mortgage insurance (PMI), reducing the overall cost of the home loan.

- Competitive Interest Rates: VA loans typically offer lower interest rates than conventional loans, helping reduce monthly mortgage payments.

- Flexible Credit Requirements: VA loan eligibility criteria are often more lenient than traditional loans, allowing individuals with less-than-perfect credit scores a greater chance to qualify for a mortgage.

- Refinancing Options: The VA offers an Interest Rate Reduction Refinance Loan (IRRRL) for refinancing to a lower interest rate or converting an adjustable-rate mortgage to a fixed-rate mortgage with minimal paperwork.

Restrictions and Loan Limits

- Primary Residence Requirement: VA loans can only be used to purchase a primary residence and cannot be used for a vacation home or investment property.

- VA Funding Fee: Borrowers must pay a funding fee, which varies depending on the loan amount and whether it is the borrower’s first use of VA loan benefits.

- Loan Limits: While there are no set limits on how much one can borrow using a VA loan, lenders may have their own limits based on borrower eligibility and the property location.

- Property Condition: The Department of Veterans Affairs sets minimum property requirements to ensure homes are safe, sound, and sanitary.

- No Use for Commercial Properties: VA loans are strictly for residential properties and cannot be used for commercial enterprises or to buy land without a home structure.

Eligibility and Certificate of Eligibility

Who Is Eligible for a VA Loan?

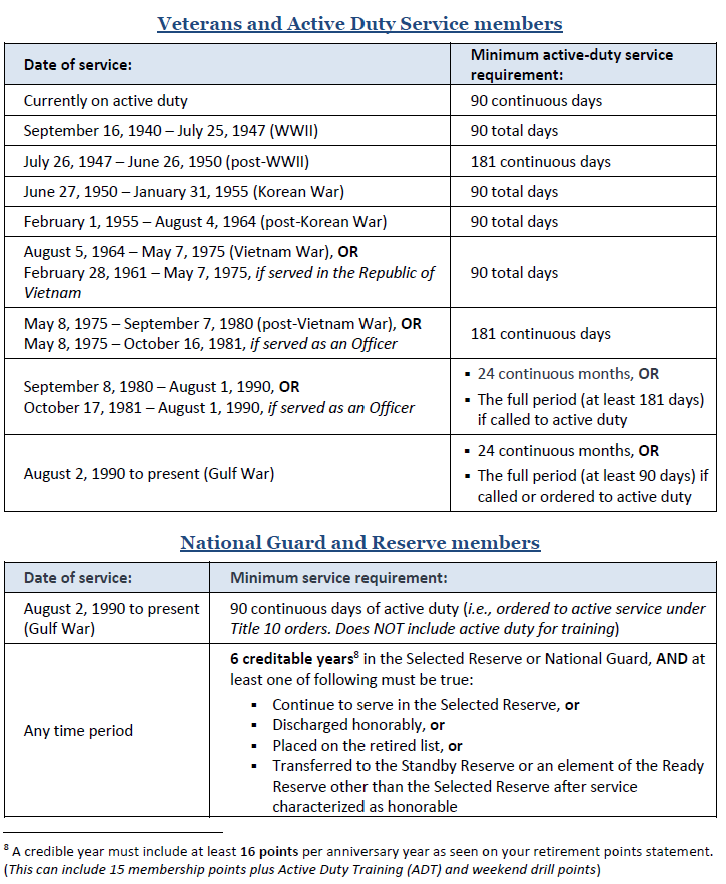

VA loans are available to veterans, active-duty service members, National Guard members, reservists, and some surviving spouses. Eligibility is determined based on service history and duty status. Veterans must have served a minimum period, typically 24 continuous months of active duty, or at least 90 days during wartime or 181 days during peacetime for individuals called or ordered to active duty. National Guard and reserve members must have at least six years of service unless they were called to active duty, in which case the same 90-day wartime or 181-day peacetime active duty requirements apply. Some surviving spouses are also eligible, particularly if the service member died in service or due to a service-related disability.

Exceptions to Minimum Service Requirements

Service members who were discharged before completing the minimum service requirements may still qualify for a VA-guaranteed home loan if they were discharged for one of the following reasons:

- Hardship

- Convenience of the government (must have served at least 20 months of a 2-year enlistment)

- Early out (must have served 21 months of a 2-year enlistment)

- Reduction in force

- Certain medical conditions

- A service-connected disability (a disability related to military service)

Obtaining Your Certificate of Eligibility (COE)

- A Certificate of Eligibility (COE) proves that an individual meets the VA’s requirements for a VA loan. It can be obtained online, through a lender, or by mail. Veterans and service members can request a COE via the VA’s eBenefits portal for quick results. Most lenders can access the VA’s automated system to get a COE on behalf of the borrower. Alternatively, completing a Request for a Certificate of Eligibility (VA Form 26-1880) and sending it to the regional loan center’s address is an option, though it can take longer.

- Documents needed may include proof of service, such as a DD214 for veterans or a statement of service for active-duty members. National Guard and reserve members may need additional documentation, such as NGB Form 22 or 23.

The VA Loan Application Process

Prequalification, Preapproval, and Documentation

The first step in the VA loan application process is prequalification, which can help identify your potential loan amount and highlight areas for improvement before moving forward. During prequalification, you’ll have a candid conversation with your VA loan professional about your income, credit history, employment, marital status, and other factors. This step can save time and prevent surprises later in the process by revealing areas that need improvement, such as credit or debt-to-income ratio. Although a prequalification letter gives you a ballpark price range for house hunting, it does not guarantee loan approval.

Following prequalification, preapproval is the next crucial step. This involves submitting an application to a mortgage lender along with necessary financial documents, such as pay stubs, tax returns, and bank statements. Lenders will also require a Certificate of Eligibility (COE) to confirm that the applicant is eligible for a VA loan.

Preapproval lets you know how much home you can afford and gives you a stronger position when making an offer on a home. Remember that this stage can also involve a credit check, so ensure your credit report is accurate and up to date.

Finding a Home with a Real Estate Agent

Working with a real estate agent can be incredibly beneficial in the home-buying process. An experienced agent can help you find a home that meets your needs, negotiate the purchase price, and guide you through the entire process, ensuring a smoother and more efficient experience. Their expertise can be especially valuable in navigating VA loans’ specific requirements and benefits.

Underwriting and VA Appraisal

Once you have found the home you want to purchase and signed a purchase agreement, the loan application enters the underwriting phase. During underwriting, the lender reviews all documents to ensure the borrower meets the necessary criteria, verifying income, employment, and other aspects of the applicant’s financial history. Concurrently, the lender requests a VA-approved appraiser to evaluate the property. This appraisal ensures the home meets the VA’s minimum property standards and provides an estimated market value.

The underwriting process can take several weeks. If there are issues with documentation or the appraisal, the lender might request additional information. If the appraised value is lower than the purchase price, the borrower can request a Reconsideration of Value or renegotiate the sale price with the seller. Alternatively, the borrower can bring cash to the closing to cover the difference between the appraised value and the purchase price. Once underwriting is completed and the appraisal is satisfactory, the mortgage can move forward to closing.

Financial Considerations of VA Loans

VA Loan Funding Fee and Other Costs

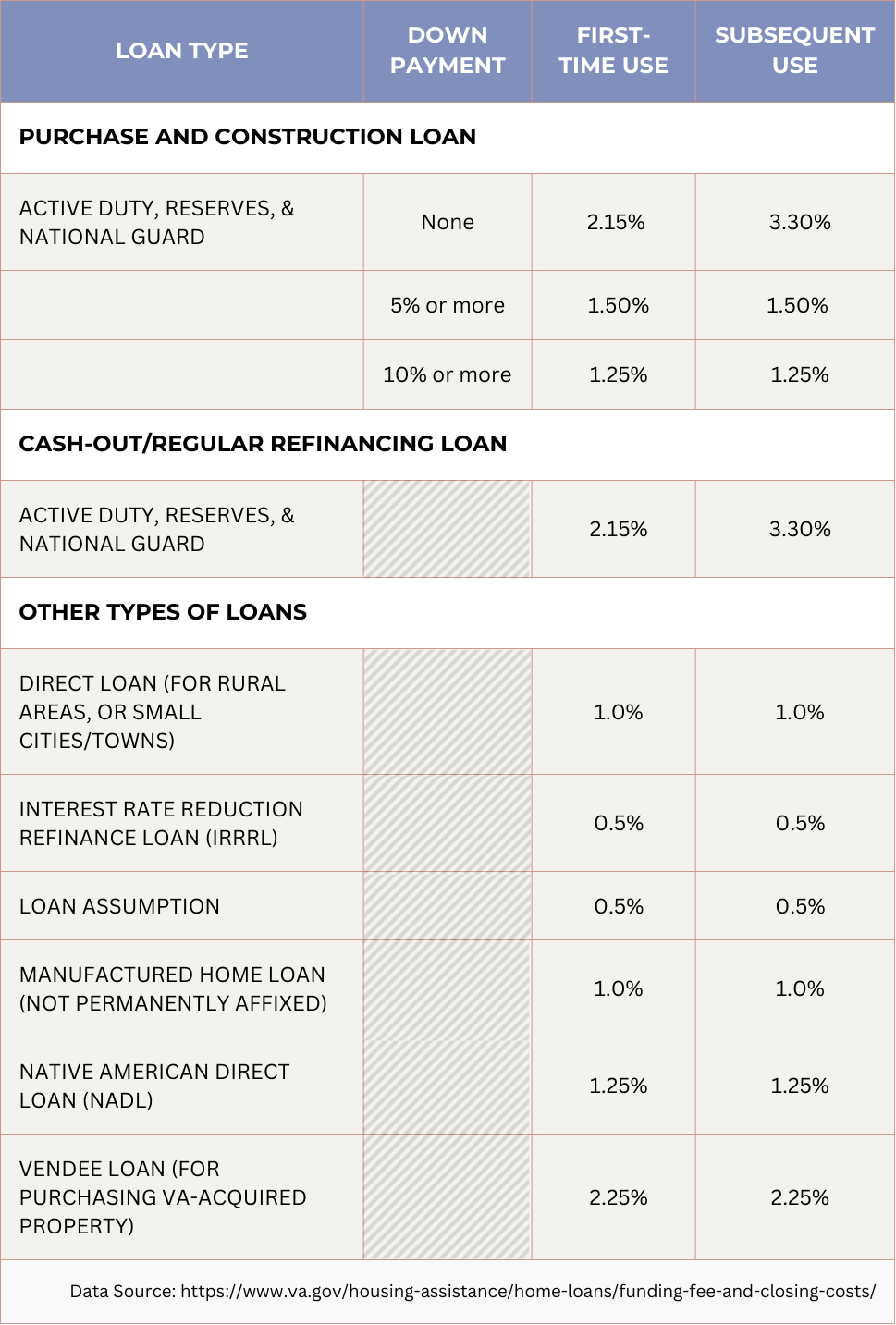

The VA loan funding fee is one of the most notable costs associated with VA loans. This fee is paid directly to the Department of Veterans Affairs and is currently capped at 3.3% of the loan amount. The exact fee depends on factors like the type of service and whether it is the first or subsequent use of the benefit. The following table provides a detailed breakdown of the funding fees based on these factors.

In addition to the funding fee, borrowers should be aware of other potential costs when purchasing a home with a VA loan. These include:

- Appraisal Fees: The appraisal is mandatory for purchase and cash-out refinance loans. A VA-approved appraiser will determine the reasonable value of the home to ensure it meets basic property requirements and the loan amount can be guaranteed.

- Closing Costs: These mandatory fees paid at closing can include taxes, transfer fees, origination fees, and other customary costs. Borrowers can negotiate with the seller to cover some of these costs, provided that seller concessions do not exceed 4% of the sale price.

- Credit Report Fees: These are the costs associated with obtaining a credit report, which is required for loan approval.

- Title Insurance: Lender’s title insurance is usually required to protect against legal claims against the home, while owner’s title insurance, although optional, is highly recommended to protect the buyer’s investment.

- Down Payment: While VA loans often do not require a down payment, making one can help lower the monthly payment and the overall loan amount. A lower funding fee may also apply if the down payment is at least 5%.

- Discount Points: There are optional fees that borrowers can pay to lower their interest rates. They can be negotiated to be paid by the seller or another party.

- Earnest Money Deposit: An optional deposit to show serious intent to purchase the home.

- Home Inspection: Although optional, the VA highly recommends a thorough home inspection to ensure no surprise issues with the home.

However, it’s worth noting that private mortgage insurance (PMI) is not required with VA loans, which can save borrowers significant money over the life of the loan.

Comparing VA Loans and Conventional Mortgages

VA loans offer several distinct advantages over conventional mortgages. They typically do not require a down payment, whereas conventional loans often require at least 5% down. VA loans also tend to offer lower interest rates, which can result in significant savings over the life of the loan. Moreover, unlike conventional loans, VA loans do not require PMI, which can lower monthly payments. However, borrowers should consider the income and credit score requirements. Although VA loans are often more flexible, a higher credit score may result in better interest rates. Potential borrowers must compare these aspects to determine which type of mortgage best suits their financial situation.

Property and Occupancy Requirements

Meeting Minimum Property Requirements

A property must meet specific minimum property requirements (MPRs) to be eligible for a VA loan. The VA assigns an appraiser to ensure the property is safe, structurally sound, and sanitary, covering aspects like the foundation, roof, and electrical systems. Properties must have adequate living spaces, such as bedrooms, bathrooms, and kitchens. If the property doesn’t meet these MPRs, repairs may be needed before the loan can be approved.

Occupancy and Property Types

VA loans require the borrower to use the property as a primary residence, typically moving in within 60 days of closing. The VA restricts the types of properties that qualify, excluding second homes and investment properties. However, multi-family units like duplexes are eligible if the borrower occupies one of the units.

Required Loan Documents

Lender-Required Documents

Most lenders will require various documents to estimate the loan amount, interest rate, and other requirements for loan approval. These documents include:

- Certificate of Eligibility (COE) or VA Form 26-1880

- Uniform Residential Loan Application (URLA)

- Credit report

- Proof of income (pay stubs, tax returns, bank statements)

- Documentation of outstanding debts

- Homeowner’s or Condominium association forms (if applicable)

- Gift letter for gift funds provided by someone not involved in the sale (if applicable)

VA-Required Documents

When requesting a COE, the VA will verify your eligibility for a VA-guaranteed loan and whether you are exempt from paying the VA funding fee. Required documents include:

- Certificate of Eligibility (COE) or VA Form 26-1880

- VA service-connected disability award letter (if applicable)

- Condo form (if applying for a condo)

The VA ‘Escape Clause’

The VA ‘Escape Clause’ protects the buyer in case the property’s appraised value is lower than the purchase price. It must be included in the sales contract for all VA-guaranteed loans. This clause allows the buyer to void the contract without penalty if the appraised value is less than the purchase price, providing an option to avoid overpaying for a property.

Home Inspections

While not required by the VA, a home inspection is highly recommended. A thorough inspection provides a detailed assessment of the home’s condition, including heating, cooling, plumbing, and electrical systems. This helps identify potential issues and can be used to negotiate repairs or price reductions with the seller.

At Closing: Buying Your Home

Closing involves signing various documents and paying any required fees. The lender provides a Closing Disclosure at least three business days before closing, detailing the loan terms and costs. Depending on local practices, the closing process may take place at a title company, escrow office, or attorney’s office. Ensure you review and understand all documents before signing.

Post-Purchase: Mortgage Servicing

After purchasing your home, your mortgage will be serviced by a company responsible for processing payments and managing your escrow account. Your servicer may not be the same company that originated your loan. If you encounter issues with your servicer, contact the VA Regional Loan Center for assistance.

Refinancing with a VA Loan

VA Streamline Refinance (IRRRL)

The VA Streamline Refinance, or Interest Rate Reduction Refinance Loan (IRRRL), helps veterans lower their existing VA loan interest rates with minimal paperwork, often without a new appraisal or credit check. It’s used to reduce monthly payments or transition from an adjustable-rate mortgage to a fixed-rate one. The funding fee for an IRRRL is relatively low, set at 0.5% of the loan amount, and can often be rolled into the new loan. Applicants should ensure their current loan is at least six months old and have made at least six consecutive monthly payments to qualify.

VA Cash-Out Refinance Options

A VA Cash-Out Refinance allows homeowners to refinance their existing mortgage and withdraw cash from their equity, which can be used for purposes such as home improvements, debt consolidation, or funding significant expenses. First-time users of the VA Cash-Out Refinance pay a funding fee of 2.15% of the loan amount, which increases to 3.3% for subsequent uses. This option requires a full appraisal and a thorough credit check. Veterans can refinance up to 100% of their home’s appraised value, though most lenders typically limit this to 90%.

Additional VA Loan Options

Energy Efficient Mortgage (EEM)

An Energy Efficient Mortgage (EEM) can be used in conjunction with a VA purchase or refinance loan to make energy-efficient improvements to a home. The VA allows up to $6,000 worth of improvements to be included in the loan. These improvements can include solar heating, insulation, and storm windows. The cost of these improvements is typically offset by reducing utility costs over time.

Alteration and Repair Loan

A VA Alteration and Repair Loan allows borrowers to include the cost of repairing or altering a home in their VA loan. This can be used for both purchase and refinance loans. Common alterations include roof repairs, foundation work, and electrical or plumbing upgrades. The repairs must bring the home up to VA’s minimum property requirements.

Construction Loan

VA construction loans can be used to build a new home on the property that you already own or plan to purchase. These loans are more complex and require finding a lender experienced with VA construction loans. The loan process involves an appraisal based on plans and specifications, and the loan is typically closed before the start of construction, with disbursements made as the construction progresses.

Farm Residence Loan

VA loans can be used to purchase, construct, repair, alter, or improve a farm residence that the borrower intends to occupy. However, the loan cannot cover the non-residential value of farmland or farm-related structures like barns and silos. Borrowers planning to use farm income to support loan payments need to demonstrate their farming experience and provide a detailed plan for farm operations.

Loan Assumption

VA loans can be assumed by another person, even if they are not a veteran. This can be a beneficial option if interest rates rise, making the low interest rate on the VA loan attractive to a potential buyer. The assumer must qualify for the loan, and the original borrower remains responsible if the loan defaults unless the assumer is also a qualified veteran and substitutes their own VA entitlement.

Conclusion

VA loans are a powerful financial tool designed to make homeownership accessible and affordable for veterans and service members. VA loans provide significant advantages over conventional mortgages by offering no down payment, competitive interest rates, and the absence of private mortgage insurance. Understanding the eligibility requirements, application process, and unique benefits of VA loans can help potential homebuyers confidently navigate the journey to homeownership. Whether you are a veteran, an active-duty service member, or a surviving spouse, leveraging the benefits of a VA loan can be a critical step toward achieving your dream of owning a home. By staying informed and proactive throughout the process, you can maximize the advantages offered by VA loans and secure a stable, affordable housing solution for you and your family.

If you have any additional questions or need help getting started on the VA loan process, feel free to reach out.

Great Article. I was wondering if it’s possible to get the VA funding fee waved or reduced?

There are a few different ways to get the VA funding fee waived or reduced.

Waiver for Disabled Veterans:

-If you’re a veteran receiving VA compensation for a service-connected disability, you don’t have to pay the funding fee.

Waiver for Surviving Spouses:

-Surviving spouses eligible for a VA loan, especially those whose spouses passed away in service or due to a service-related disability, can also have this fee waived.

Reduction with Down Payment:

-If you make a down payment of at least 5%, you can reduce the funding fee, which helps lower the overall cost of the loan.

I hope that helps.

Can you rent out a home bought with a VA loan if you have to relocate for military service?

Absolutely, you can rent out a property purchased with a VA loan if you have to relocate due to service obligations, but there are a few things to keep in mind.

Primary Residence Requirement

VA loans are specifically designed to help veterans and active-duty service members purchase homes that they will use as their primary residence. This means that when you first buy the home, you must intend to live in it as your main home. However, life happens, and the VA understands that military service often requires relocation.

Relocation Due to Service

If you’re relocated because of a permanent change of station (PCS) or other service-related orders, the VA does allow you to rent out your property. This is one of the more flexible aspects of a VA loan. You’re not required to sell your home or stop using your VA loan benefits just because you’ve been ordered to move.

Lender Considerations

While the VA allows you to rent out the property, your lender might have specific terms regarding this. It’s a good idea to check your mortgage agreement or talk to your lender to understand any conditions they may impose. For example, some lenders might have a clause about how long you need to live in the home before you can rent it out, or they may require notification before you turn the property into a rental.

Occupancy Requirement

Generally, the VA expects you to occupy the home within 60 days of closing. However, if you’re deployed or receive PCS orders, this timeline can be extended. Once you’ve lived in the home as your primary residence, you have more flexibility to rent it out later if necessary.

Future VA Loan Use

One thing to keep in mind is that if you plan to buy another home with a VA loan after relocating, you’ll need to consider your remaining entitlement. Renting out your current VA-financed home doesn’t necessarily mean you can’t use your VA loan benefits again, but the amount of your remaining entitlement will affect how much you can borrow for the next property.

Rental Income Consideration

If you do rent out the property, any rental income you earn can be considered when you apply for a new VA loan. This can be particularly helpful in offsetting your existing mortgage payments and improving your debt-to-income ratio, which lenders look at when determining how much you can borrow for a new home.

In summary, yes, you can rent out your VA loan-purchased home if you have to move because of your service, but it’s essential to check with your lender and understand any specific requirements or restrictions. Doing so ensures you stay within the guidelines and make the most of your VA loan benefits.

That’s so true about checking with the lender. I learned the hard way when mine had different rules than I thought.