Introduction

Applying for a home loan can be a daunting process, especially for first-time homebuyers. Various challenges and financial hurdles can arise, ranging from credit issues to employment history, each potentially complicating your journey to homeownership. Understanding these common obstacles and potential solutions can significantly ease the process and increase your chances of securing a favorable mortgage. This article will delve into 11 prevalent challenges borrowers face and offer practical workarounds to help you successfully navigate the home loan application process.

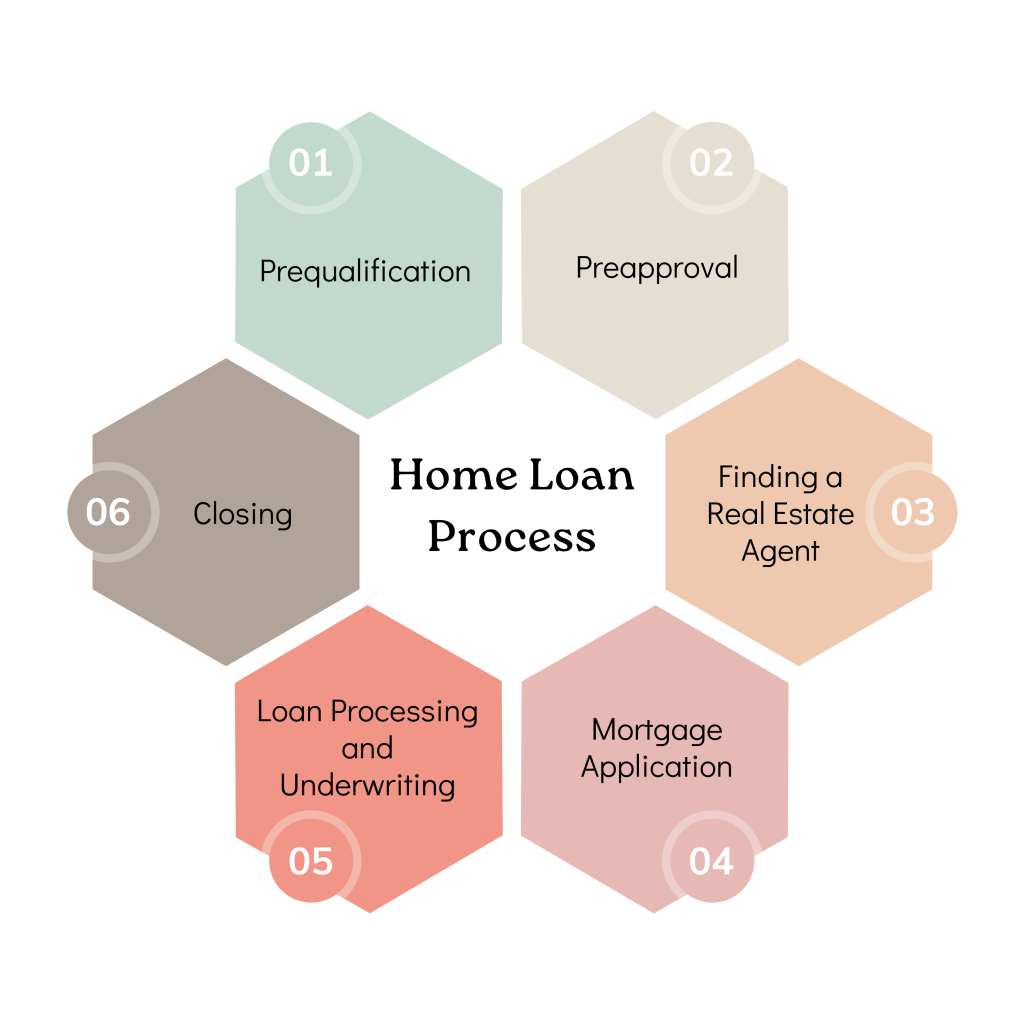

Understanding the Home Loan Process

Before diving into specific challenges, it’s essential to understand the basic components of the home loan process. Typically, it includes:

- Prequalification: The first step in the mortgage process is prequalification, which helps identify your potential loan amount and highlight areas for improvement before moving forward. During prequalification, you’ll have a candid conversation with your loan officer about your income, credit history, employment, marital status, and other factors. This step can save time and prevent surprises later in the process by revealing areas that need improvement, such as credit or debt-to-income ratio. Although a prequalification letter gives you a ballpark price range for house hunting, it does not guarantee loan approval.

- Preapproval: Following prequalification, preapproval is the next crucial step. This involves submitting an initial application to a mortgage lender along with necessary financial documents, such as pay stubs, tax returns, and bank statements. Preapproval lets you know how much home you can afford typically based on your monthly income and gives you a stronger position when making an offer on a home. This stage can also involve a credit check, so ensure your credit report is accurate and up to date. The lender will also issue a preapproval letter, which indicates how much they are willing to lend you based on your financial situation.

- Finding a Home with a Real Estate Agent: Working with a real estate agent can be incredibly beneficial in the home-buying process. An experienced agent can help you find a home that meets your needs, negotiate the purchase price, and guide you through the entire process, ensuring a smoother and more efficient experience. Their expertise can be especially valuable in navigating specific loan requirements and benefits.

- Mortgage Application: Once you find a home, you’ll need to submit a formal mortgage application. This is when the lender will begin the detailed process of verifying all the financial information you provided during preapproval. This includes a home appraisal to determine the property’s value and performing a title search to ensure the property is clear of any legal issues.

- Loan Processing and Underwriting: During this stage, the lender will continue to verify your financial details, review the home appraisal, and check the title search results. Underwriting involves a thorough review of your financial documents to assess the risk of lending money to you. The lender will verify income, employment, and other aspects of your financial history.

- Closing: If the underwriter approves your loan and the appraisal is satisfactory, you’ll move on to closing. This involves signing the final paperwork, paying closing costs, and officially transferring ownership of the property.

Understanding these steps can help you prepare for each stage of the home loan process and address potential issues proactively.

Common Challenges and Potential Solutions for Home Loan Applicants

1. Low Credit Score

- Challenge: A low credit score is one of the most common barriers to securing a mortgage. Lenders use credit scores to assess the risk of lending money to you. A lower score can result in higher interest rates or even denial of the loan.

- Solutions:

- FHA Loans: Federal Housing Administration (FHA) loans are designed to help borrowers with lower credit scores. These loans typically require a lower down payment and have more lenient credit requirements.

- Credit Repair: Improving your credit score is a long-term strategy that involves paying off outstanding debts, disputing any errors on your credit report, and maintaining a low balance on credit cards. Financial counseling services can also provide guidance on improving your credit profile.

- Example Loan Options: FHA loans are ideal for borrowers with credit scores as low as 580. Another option is subprime loans, which are available for borrowers with lower credit scores but come with higher interest rates.

2. High Debt-to-Income (DTI) Ratio

- Challenge: Lenders look at your DTI ratio to determine if you can manage monthly mortgage loan payments in addition to your existing debt, which impacts your financial stability.

- Solutions:

- Pay Down Debts: Focus on paying off high-interest debts to lower your DTI ratio. This not only helps in loan approval but also improves your overall financial health.

- Increase Income: Any additional income, such as a part-time job or side gig, can improve your DTI ratio. Documenting consistent additional income can make you more appealing to lenders.

- Larger Down Payment: Saving up for a larger down payment reduces the loan amount you need, thereby improving your DTI ratio. Additionally, a larger down payment can sometimes secure better loan terms.

- Example Loan Options: VA loans are a great option for veterans with high DTI ratios, as they often have more lenient requirements. Another option is to look into income-based loans that consider potential future income growth.

3. Insufficient Down Payment

- Challenge: Many lenders require a substantial down payment, and insufficient savings can limit your options.

- Solutions:

- Down Payment Assistance Programs: Various federal, state, and local programs offer down payment assistance, grants, or low-interest loans to help buyers secure the necessary funds without paying for private mortgage insurance.

- Gift Funds: Family members can provide gift funds for your down payment. Lenders often require a gift letter to confirm that the money is not a loan.

- Low Down Payment Loans: Programs like FHA, VA (for veterans), and USDA (for rural areas) loans require lower down payments, typically as low as 0-3.5%.

- Example Loan Options: VA loans for veterans can provide 100% financing, requiring no down payment. USDA loans for rural properties also offer 100% financing options.

4. Unstable Employment History

- Challenge: Lenders prefer a stable employment history, usually at least two years with the same employer or in the same field. Frequent job changes or gaps can be a red flag when applying for a home loan.

- Solutions:

- Provide Explanations: If you have a valid reason for job changes or gaps, such as relocation or further education, provide documentation and a clear explanation to your lender.

- Show Continuous Employment: Even with job changes, maintaining continuous employment in the same industry can help. Freelancers or contractors should provide consistent income documentation and contracts.

- Example Loan Options: An FHA loan tends to be more flexible with employment history. Another option is portfolio loans, which are kept by lenders instead of being sold on the secondary market and often have more flexible underwriting standards.

5. Property Issues

- Challenge: Sometimes, the property itself can cause issues, such as failing to appraise at the sale price or having title problems.

- Solutions:

- Appraisal Re-evaluation: If you believe the appraisal is incorrect, you can request a re-evaluation or provide additional comparable sales data to support the property’s value.

- Title Insurance: Title insurance protects against future claims or disputes over the property. Ensuring a clear title before closing can prevent legal issues down the line.

- Example Loan Options: Conventional loans may require a second appraisal or additional documentation if property issues arise. FHA loans also have specific property standards that must be met.

6. Insufficient Income Documentation

- Challenge: Self-employed individuals or those with irregular income may struggle to provide the necessary documentation for traditional loans.

- Solutions:

- Bank Statement Loans: Some lenders offer bank statement loans, which use bank statements as proof of income instead of traditional pay stubs and tax returns.

- P&L Statements: Providing profit and loss statements, balance sheets, and other financial documents can help demonstrate stable income for self-employed borrowers.

- Example Loan Options: Bank statement loans and no-documentation loans are designed for self-employed borrowers with irregular income documentation.

7. High Interest Rates

- Challenge: High interest rates can make monthly mortgage payments unaffordable, affecting your overall budget.

- Solutions:

- Rate Shopping: Different lenders offer varying rates. Compare rates from multiple lenders to find the best deal on your home loan.

- Buydown Options: Paying points upfront to lower the interest rate can result in lower monthly payments over the life of the loan.

- Improve Credit Score: A higher credit score can qualify you for better interest rates. Focus on improving your credit score before applying.

- Example Loan Options: Adjustable-rate mortgages (ARMs) often start with lower interest rates compared to fixed-rate mortgages. Refinancing options can also help lower interest rates after improving credit scores.

8. Loan Limits

- Challenge: With soaring home prices in some high-cost areas, conforming loan limits may not be adequate, restricting your borrowing capacity.

- Solutions:

- Jumbo Loans: Jumbo loans are designed for loan amounts exceeding conforming limits. They often require a higher credit score and a larger down payment but can finance more expensive properties.

- Higher Down Payment: Saving for a larger down payment can reduce the amount you need to borrow, keeping it within conforming loan limits.

- Example Loan Options: Jumbo loans for high-value properties and conforming loans with a larger down payment to avoid exceeding loan limits.

9. Limited Housing Inventory

- Challenge: In a competitive market, finding an affordable home that meets your needs can be challenging.

- Solutions:

- Expand Search Area: Consider looking in a broader geographic area or exploring different types of properties, such as fixer-uppers or homes in emerging neighborhoods.

- Preapproval: Getting pre-approved for a loan can make you a more attractive buyer, as it shows sellers you are serious and financially prepared.

- Flexible Closing: Being flexible with your closing date or offering to cover certain closing costs can make your offer more appealing to sellers.

- Example Loan Options: FHA 203(k) loans for fixer-uppers allow you to finance both the purchase and renovation costs with a single mortgage. Conventional loans with flexible terms can also be beneficial in competitive markets.

10. Student Loan Debt

- Challenge: Student loan debt can significantly impact your ability to qualify for a mortgage by increasing your DTI ratio and affecting your credit score.

- Solutions:

- Income-Driven Repayment Plans: Switching to an income-driven repayment plan can lower your monthly student loan payments, reducing your DTI ratio.

- Refinancing Student Loans: Refinancing your student loans to get a lower interest rate or extended repayment term can also reduce your monthly payments.

- Deferred Payments: If you’re eligible, deferring your student loan payments temporarily can improve your DTI ratio during the mortgage application process.

- Example Loan Options: FHA loans may be more lenient for borrowers with significant student loan debt. Another option is conventional loans with Fannie Mae’s student loan cash-out refinance program, which allows you to pay off student loan debt through mortgage refinancing.

11. Qualification Requirements

- Challenge: Meeting all the qualification requirements for a specific loan program can be stringent and overwhelming.

- Solutions:

- Alternative Loans: Explore alternative loan options, such as government-backed loans, such as VA loans for veterans, USDA loans for rural properties, or portfolio loans offered by specific lenders that cater to unique financial situations.

- Co-Signer: Having a co-signer with a strong credit profile and stable income can help you qualify for a loan if you are facing difficulties on your own.

- Example Loan Options: VA and USDA loans offer more lenient qualification requirements. Portfolio loans are another option for those with unique financial situations that don’t fit traditional criteria.

Conclusion

Navigating the home loan application process can be complex, with numerous challenges that potential borrowers may face. However, understanding these obstacles and knowing the available solutions can make a significant difference. You can increase your chances of securing a favorable mortgage by exploring different loan types, improving your credit profile, managing your debt-to-income ratio, and leveraging assistance programs. With the right preparation and guidance, you can overcome these challenges and move closer to achieving your dream of homeownership.

If you have any additional questions or need help getting started on the loan process, feel free to reach out.